The Wealth Story: Investing in Indian Wealth Managers

India's wealth management industry should be a long term growth story but can these stocks deliver returns?

India’s wealth management industry stands to benefit from a growth in UHNIs/HNIs, high income earners, affluent and aspirational middle class. A growing count of Unicorn startups and SME IPOs providing exit to founders/promoters further aids the Wealth Management segment. I have worked in the wealth management space in different capacities and have seen this industry evolve over the past decade from a low trust product selling industry to a more professional research driven industry. I am trying to wrap my head around the longevity and secularity of growth, and if the premium multiples that these stocks command can de-rate if there is cyclicality during prolonged weak market conditions. Broadly, here are some key trends:

Growing HNI/Ultra-HNI base:

India's High Net Worth Individual (HNI) population is expected to grow between 12%-16% per annum

There are ~ 3 million affluent and HNI families in India and 35,000 Ultra HNI families.

Taxpayers having income of > Rs. 1 crore, grew by 15% from FY18 to FY23 and reached 1.7 Lakhs. With the same growth, the number of individuals will increase to 3.40 lakhs by FY27-28.

The number of ITR filers with income > Rs 1 Crore per annum increased from ~44k in FY13 to ~230k in FY23.

Financialization of Savings:

Over the last decade, there has been a rapid rise in financialization of India’s household savings.

Mutual Funds: MF AUM as a % of GDP is between 15%-17% for India vs. 60%-65% of global average. This has increased from ~6%-7% in 2014 for India.

The share of Mutual Funds in financial assets of households was 11% in FY24, up from 3% in FY14. Source: RBI.

Flow of gross savings in mutual funds has increased from ~1% in FY12 to ~7% in FY14.

The monthly SIP flow has grown from Rs ~3,100 Crores in Apr’16 to Rs 26,400 Crores in Jan’25.

Direct Stocks: As per NSE’s 2024 data, there were 11 Crore unique demat account holders in India representing ~7.5% of India’s population. This has increased from ~2% in 2014.

Indian Wealth Management (WM) Companies

The WM space in India has niche players who solely focus on WM and in-house WM verticals of banks, investment banks and stock brokers.

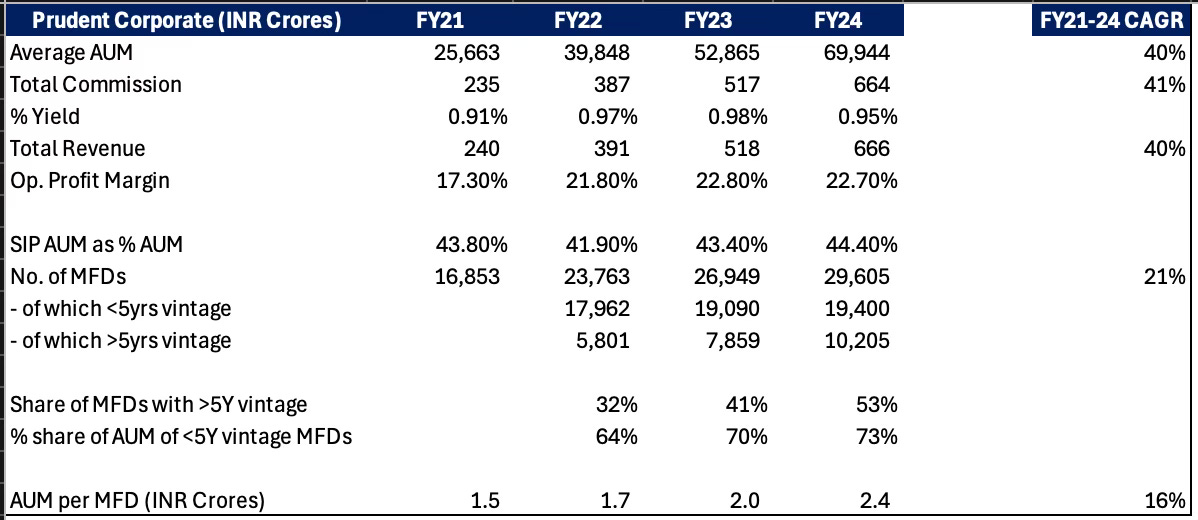

Independent practitioners (RIAs/MFDs), national level players with a B2B2C approach (NJ, Prudent) usually cater to lower ticket size investors (< Rs 1 Crore of investments).

Boutique WM firms, WM verticals of banks, MNC banks, investment banks and stock brokers (Kotak Wealth, Anand Rathi Wealth, 360 One WAM, Nuvama, Motilal Oswal Wealth, Avendus, Waterfield Advisors, Julius Baer etc.) cater to a range of investors - HNI, Ultra HNI and Family offices.

A misconception is that these firms simply sell products and earn commissions which isn’t true - this is what typically banks and insurance/mutual fund agents used to do but the scenario has evolved over the past few years as those with larger networth started demanding sophisticated services. Today professional wealth managers engage with clients on cashflow planning, asset allocation, product selection, reviews, tax planning, estate planning and a host of other services while trying to deliver an alpha over the index. Products now include direct equities, mutual funds, PMS/AIFs and alternate assets such as pre-IPO opportunities, high yield credit, commercial real estate etc.

The business model for most of the players is a recurring revenue model charged on assets advised. The revenue is either charged as a fee from the clients or as a commission from the asset manager (MF, AIF, PMS, etc.). While independent wealth managers (RIAs/MFDs) are driven by a single person, the larger wealth managers have a “Relationship Manager” driven model.

Takeaways from Financials

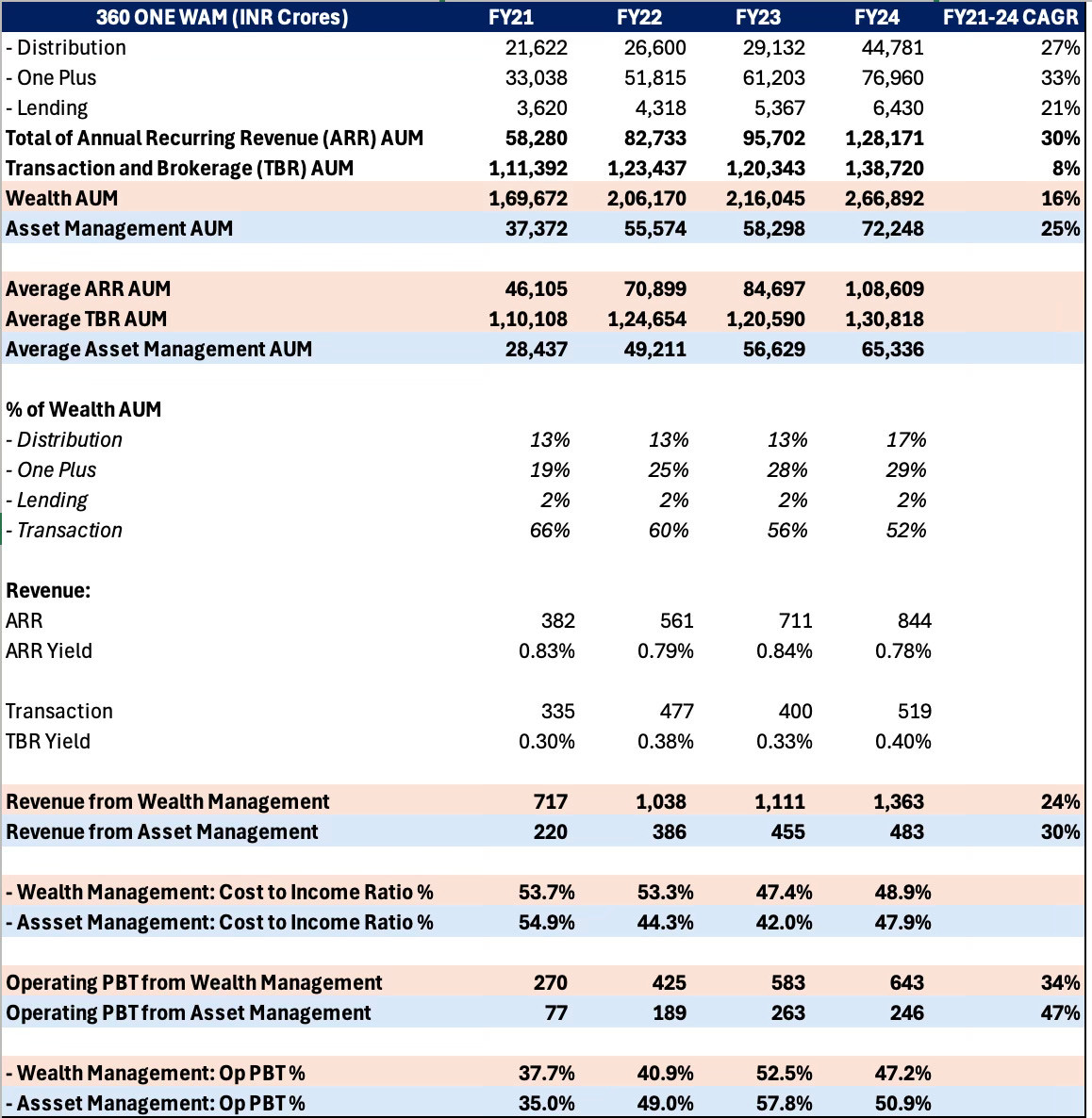

The wealth AUM growth has been strong thanks to MTM gains, inorganic expansion and a general increase in professionally managed financial assets.

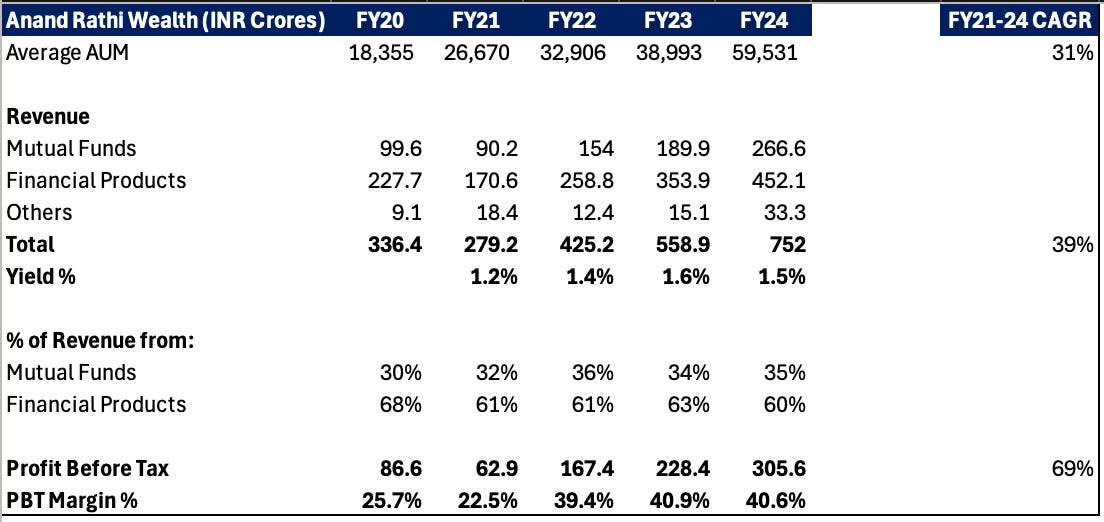

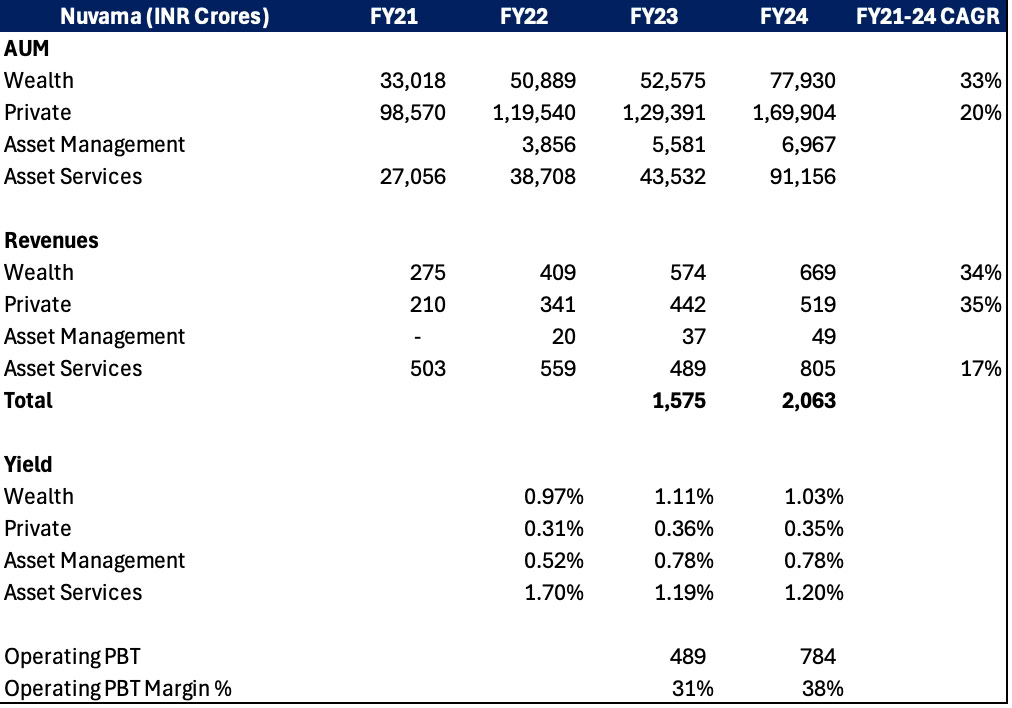

Yields vary across players depending on offerings. The yield from mutual fund distribution business is ~1% while private wealth management has lower yields of ~0.4%.

Anand Rathi Wealth enjoys high yields (>1.4% of AUM) largely from its MLD business.

Prudent has yields of ~1% but passes on 0.65%-0.7% to MFDs selling under Prudent’s ARN (kind of like sub-brokers).

360 One WAM has an average recurring yield of ~0.8% blended between its distribution and private wealth business.

Employee expenses as a % of overall revenues were 38% of 360One, 43% for Anand Rathi and 44% for Nuvama on FY24 numbers. Employee expenses as a % of revenues can shoot up sharply during down market cycles (MTM losses and outflows reduce AUMs and thus revenues). This will have a direct impact on the operating margins of wealth players. The opposite plays out in bull markets as growth in AUM and Revenues outpaces that of employee expenses.

Prudent has a B2B2C model and thus its employee expenses were lower at 11% in FY24. Prudent has commission and other costs of 55% of revenues.

Increase RM efficiency and Vintage:

Financial incentives of the RM aligned to vintage, low willingness of clients to shift their AUM to another firm along with the RM and a desire to show stability to clients leads to low RM churn in the business.

Relationship Managers typically take 18-24 months to reach full efficiency. The AUM/RMs is increasing due to MTM gains and tech driven efficiency but there will always be a limit on the number of clients an RM can efficiently handle especially when these firms are servicing high AUM clients.

Business Risks

While recurring revenues and fees provide visibility of revenues I believe that the business has an element of cyclicality to it:

When markets correct, AUM reduces on account of MTM losses and inflow of money slows down and can even turn negative. This has a direct affect on revenues.

Players such as Nuvama and 360 One also have significant income from transaction services such as stock broking, IB deals, Asset Management, etc. Weak market conditions can dry up business volumes and revenues.

As mentioned in an earlier point, during weak market conditions employee expenses as a % of revenue can shoot up and drag profit margins.

The segment is open to competition from banks, stock brokers and niche wealth managers.

Increase in mix of private wealth and passive investing will lead to lower yields. AUM growth must compensate for a loss in this revenue. Even the distribution business is susceptible to lower yields eventually. As AUM of mutual fund schemes grow, the total expense ratio (TER) reduces and so do the payouts to distributors.

The industry is prone to evolving regulatory changes. In the past, the industry was impacted by introduction of direct plans, ban on upfront commissions, RIA regulations, etc. However, this should ideally favour of the larger players who are better placed to navigate these changes over the medium term. Moreover, I believe that the regulatory changes have only increased the trust factor in the industry between clients and wealth managers.

Any prolonged slowdown in financial markets can decelerate the financialization of savings leading to slow AUM growth.

My Views

360 One WAM: The share of recurring revenue from the Wealth segment is ~45% while the rest is from capital markets and asset management. 360 One WAM has a strong presence in the UHNI segment and is expanding its focus on the mid-market (HNI), global segment and tier-2 cities. There could be near term cost pressures which will be even more evident if there is a market slowdown. 360 One WAM however has built a strong franchise and stands to benefit in the long term from the growth in Ultra HNI, HNI segment’s financialization of savings.

Nuvama Wealth: Both Wealth (HNI) and Private (Ultra HNI) segments are growing well and make up ~58% of the revenues while the rest comes from AMC and capital markets. However, the revenue share of wealth and capital market can fluctuate with market cycles (capital markets being more cyclical).

Anand Rathi Wealth: The company caters to the Rs 5 Crores to Rs 50 Crores cohort. While Market Linked Debentures (MLDs) form just ~25% of AUM, they make up 62% of revenues and create a strong dependence on a single product which doesn’t have as widespread an adoption as Mutual Funds do. Also, Anand Rathi Group is the largest issuer of MLDs for Anand Rathi Wealth. Caveat for investors is that Anand Rathi’s high yields depend on a single product and single issuer (related party).

Prudent Corporate Advisory: Prudent has an established B2B2C model that focuses on small ticket investors, first time investors via small AUM distributors. It has a purely recurring revenue model and has a bargaining power with AMCs (given its AUM size) and sub-distributors given their dependence on Prudent. NJ Wealth happens to be a larger B2B2C player but is unlisted. Prudent’s single product focus and expansion into smaller cities has paid off well. Prudent however is vulnerable to lowering TERs and regulations on commissions by SEBI. Moreover, “Direct fund” platforms such as Groww, Paytm Money, Zerodha etc. directly compete in the segment Prudent operates in and “Direct-only” has been gaining AUM share in the overall industry pie. I believe that this market has room for both DIY investors and MFD dependent investors.

Capital markets is a cyclical business and can cause volatility in margins and make them appear strong during strong market cycles but drag overall margins during weak cycles. India’s brokers are moving on to a more recurring model instead of transaction based revenues but even the recurring revenues are exposed to AUM volatility, lowering yields, etc.

If you want to invest on the low ticket AUM investor growth story then Prudent is an ideal choice. I think from my experience that Prudent’s business should benefit well from first time investors and demand for professionally managed wealth for low ticket investors. If you want to invest in the HNI and Ultra HNI segment story then you should further study the earnings calls, presentations and annual reports of Nuvama, 360 One, Motilal Oswal and Anand Rathi Wealth.

Valuations:

It wouldn’t make much sense to invest in Wealth Management stocks solely looking at the PE ratios. You need to look at the longevity and secularity of growth, share of volatile business segments (which have done well in the last 2-3 years) and stickiness of clients. Some of these businesses can offer a good buying opportunity during market corrections.

Further Reads:

https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/50AT_241220242A32160600414A809B97A7152AAAEF34.PDF

https://www.ey.com/en_in/industries/wealth-asset-management/money-in-motion-enabling-the-evolving-finance-sector-with-wealthtech